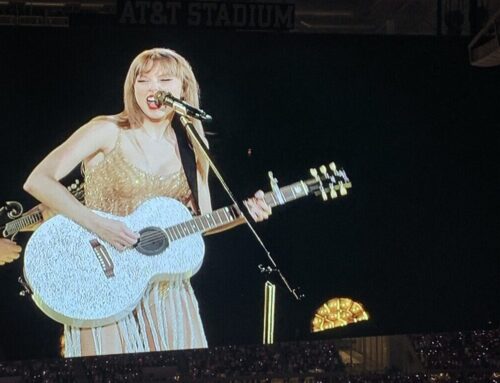

Audrey Pinkerton

This Thursday, the Dallas ISD board of trustees will be deciding whether or not to seek a 13-cent sales hike this November to raise $100 million for three popular programs, but it’s not exactly that simple.

The district would need voters to approve a tax ratification election, raising the current maintenance tax rate from $1.04 to $1.17, permanently increasing the state’s cap for operations taxes. It was last increased a decade ago in Dallas, and such tax ratification elections have been popular recently around the metroplex, with similar measures passed in Irving, Grand Prairie and Frisco. Oak Cliff representative Audrey Pinkerton (who we profiled this month) says she has more questions before she can give the plan her support.

“Some frame the issue as should we or shouldn’t we expand these programs. I frame it differently,” she says. “I’m asking, ‘Can we expand these programs by shifting dollars from other expenditures that don’t impact student learning?’ DISD administration has done a great job in implementing programs that are getting results, and they’ve identified and cut some initiatives that haven’t gotten results. As a trustee, I’m looking for these results to continue. So the important question is are we doing the most we can with the dollars already entrusted to us? If we can say that every dollar we collect is being leveraged for high impact, then we may need to go to the taxpayer for more.”

Pinkerton doesn’t question that the funds would go toward “worthwhile” programs. Of the $100 million raised, around $40 million would go toward expanding the district’s early education efforts, by providing additional resources for teachers and day-long prekindergarten for 3 year olds. Another $32 million is slated for expanding the popular efforts to allow students to earn up to 60 hours of college-level credit while still in high school, which is already in place at seven DISD schools including South Oak Cliff High School in our neighborhood. The remaining $32 million is earmarked for teacher advancement via the Accelerating Campus Excellence program, which pays high-performing teachers and administrators bonuses if they work at low-performing DISD campuses.

Pinkerton did question the timeframe on which the plan is being implemented.

“It would be nice to have a little more time to discuss and develop this proposal. We had our initial presentation of the information at [the Aug 11] board briefing and we will vote one week later,” she says.

While DISD administrators told the Dallas Morning News the measure was necessary to prepare for the future, since Dallas’ rising property values means the district will likely get less state and federal reimbursement in the coming years, Pinkerton is suspect of that.

“The possible recapture of revenue collected on the first $1 of the tax rate has been mentioned as a reason we need a tax rate increase, so I spent some time delving into Texas’ school finance system. It turns out this recapture doesn’t actually affect DISD one way or the other,” she explains. “It’s counter-intuitive, but basically the state determines how much funding each district gets based on the number of students and its demographics. Let’s say the state formula provides $7,500 per student for a particular district. If the district collects less locally, the state makes up the difference. If the district collects more – then they have to give the overage to the state. Either way, they get $7,500. I think it’s important for us to be transparent with voters about this.”

The board is coming off a recent successful election in which voters approved a $1.6 billion bond last November that will fund infrastructure and program improvements at campuses all over Dallas.

Six DISD board members would need to approve of the newly proposed tax hike for it to make the ballot this November. They will vote during a special meeting on Thursday, Aug. 18, at 5:30 p.m. in the board room at the district’s headquarters at 3700 Ross Ave.